Traditional Industry on Wrong Course, But Primerica There to Help Consumers

The traditional life insurance industry apparently has a new slant on “The Theory of Decreasing Responsibility.”

People who need life insurance the most, it seems, are the ones being ignored by traditional life insurance agents, who instead focus on wealthy clients.

“The industry’s years-long shift toward wealthier buyers is clearest in ‘permanent’ life-insurance policies, including varieties known as ‘whole life’ and as ‘universal life,’ which combine a death benefit with a savings or investment account. These represent almost three-fourths of individual-policy premiums collected,” The Wall Street Journal reported recently.

Nearly 40% of the face value of new whole-life and universal-life policies sold in 2007, according to an analysis done by LIMRA for The Wall Street Journal, were high-end policies for $2 million and up. The large policies, which can carry annual premiums of $20,000 or more, accounted for just 10% of the market a decade earlier, and 1% two decades ago.

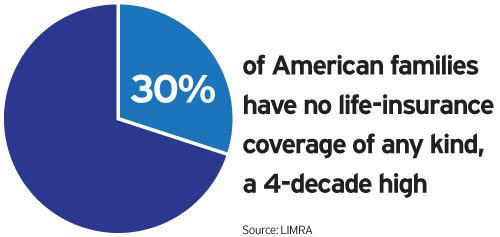

Clearly, the shift has been made – and it does not favor the middle market consumer, as the percentage of families owning life insurance continues to fall to record levels.

To make matters even worse, life insurance sales to households with children have fallen, even as the number of such households has risen.

This is where Primerica stands apart from the traditional industry. We’re a Main Street company delivering to Main Street families.

While the traditional industry is focused on wealthy clients, Primerica is helping Main Street families get the protection they need at a price they can afford.

More than 4.3 million lives are insured through Primerica, and an average of $2.5 million in benefit claims are paid every day.*

We do what’s right … and we make a difference.

Source: “Shift to Wealthier Clientele Puts Life Insurers in a Bind,” The Wall Street Journal, October 4, 2010

*Term life insurance is underwritten by National Benefit Life Insurance Company, Home Office: Long Island City, New York, in New York state; in the United States (except in New York), term life insurance products are underwritten by Primerica Life Insurance Company, Executive Offices: Duluth, Georgia; in Canada, term life insurance products and segregated funds are underwritten by Primerica Life Insurance Company of Canada, Head Office: Mississauga, Ontario.

Related

2 Comments

Comments are closed.

This is a great piece for my facebook friends. It is to the point and eyecatching. Why should’nt they know what the other insurance is for? Buy term and invest the difference is for middle income families who deserve to be able to afford their insurance premiums while freeing up money to save for the future,

Very interesting and troubling. We need to keep trying to find those who need us.