Why Doing What’s Right Counts for So Much

Mary Ann Small, of Buford, GA, was a single mother of two young children, Shari and Josh. She worked hard to keep up her family’s American dream. “I was working 139 hours a week at two jobs – as a corporate trainer and a cocktail waitress,” remembers Mary Ann. “It was exhausting but I was determined that my children weren’t going to miss out on anything. I did everything I could for them from life insurance to even a live-in nanny.”

One day Mary Ann was introduced to long-time Primerica leader Willorene Morrow. She was shocked when Willorene showed her that the cash value policies she had been paying faithfully into for years had cash values of less than $1,000 each. “Those polices were supposed to be educational funds and – at the rate we were going — I wasn’t even going to be able to pay for a year of books. I was frustrated because I had been paying hard-earned money into these policies for so long with almost nothing to show for it.” Mary Ann replaced her cash value policies with a Primerica term policy that included child riders on Shari and Josh. “I was buying the coverage that I felt better suited my family’s needs,” says Mary Ann. “But making that switch had real repercussions that I didn’t dream of at the time.”

A few years later, Josh and Shari were both in high school and Mary Ann decided to increase their riders to the maximum of $25,000. “That was really an amazing move,” says Mary Ann. “Shortly after we changed the riders, Shari was diagnosed with cancer. She was treated and has been in remission for years now. Then Josh began to experience seizures.”

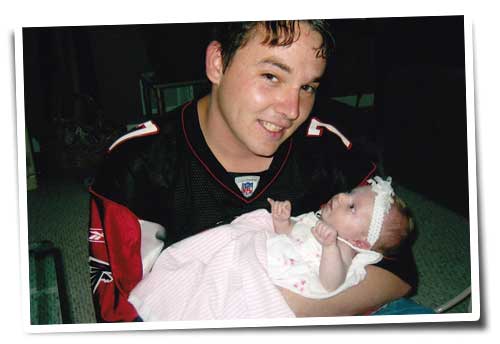

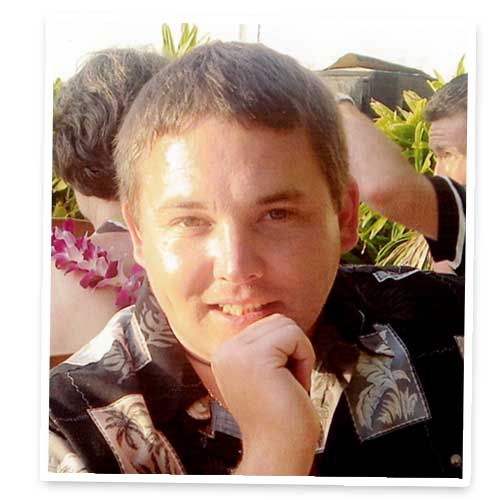

“The wonderful thing about Primerica’s coverage,” notes Mary Ann, “is that we were able to convert their child riders into their own Primerica policies for the guaranteed conversion amount without underwriting. At the time of conversion Josh requested additional coverage and was underwritten and approved for additional coverage plus a requested Increasing Benefit Rider. This was a huge help since by that time both had started families of their own — Josh with a daughter, Caylee, and Shari with a son, Trinten.

Then one day in May of 2010, Josh came home from work. He wasn’t feeling well and went to take a bath. It was while he lay in the hot bath that he died of sudden heart attack. Mary Ann remembers. “Josh used to say, ‘Hey, I’m a momma’s boy and proud of it!’ because Shari, Josh and I have always been close – they knew I sacrificed for them. We valued our time together – it was only a week before he died that Josh and I had been skiing. How could I know that my first death claim would be my own child?”

Today, Mary Ann will tell you personal philosophy is important. “I know that at Primerica we always say, ‘We do what’s right.’ But those words really meant something to my family. Primerica didn’t have to do what they did for us – there was a paperwork problem that could have been used to change the coverage — but they did what was right. Today, when I tell my story to parents who don’t think they should get the child riders for their children I ask them ‘Why not?’ None of us has a crystal ball and we just can’t know the future – so for the cost of a child rider – why wouldn’t you?

NOTE: Cash value life insurance can be universal life, whole life, etc. and may contain benefits in addition to death protection, such as dividends, interest or cash value available for a loan or upon surrender of the policy. Whole life insurance usually has a level premium for the life of the policy. Term insurance provides a death benefit only and its premiums can increase at certain ages.