Instead of working in your favor (as with a savings account), the power of compound interest works against you with debt.

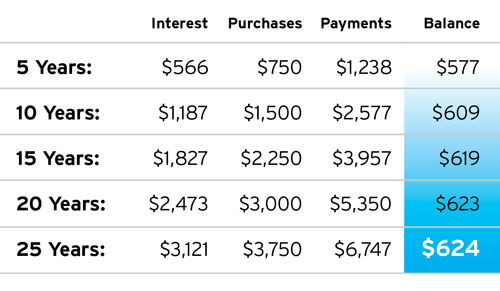

If you start with a $500 balance on your credit card at 19.8% interest, then each year make two additional charges of $75 each, and pay only the minimum monthly payment of 3.5% of the balance or $20, whichever is greater, after 25 years the interest charges amount to $3,121.

After 25 years, you still have a balance of $624!

Related

2 Comments

Comments are closed.

Share with all your friends

Ithink if everyone knew just how much $$ they were actually paying to their credit card company when they learn about compound interest and how it can work for/& against you, they will be much more careful when deciding if they REALLY NEED whatever it is they are charging, because they are actually paying far more for it than they ever thought would be legal!!!