Your credit score can determine:

• Whether you will be approved for credit

• The interest rate on your loans

• The cost of your homeowner’s and car insurance

• Whether you are approved to rent a house or apartment

Shouldn’t you know the score? Primerica’s DebtWatchers™ program gives you your FICO® credit score, notifies you via email or text messages of key changes to your Equifax Credit Report,™ and provides access to four Equifax credit reports every 12 months with continuous enrollment.

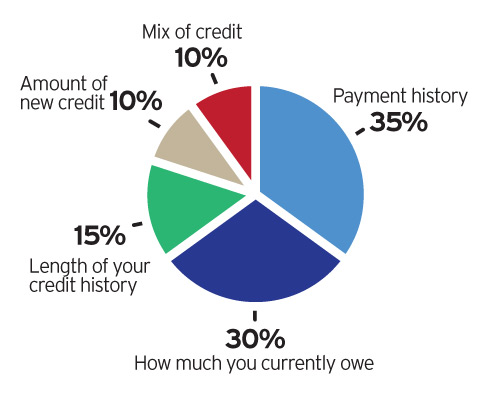

What Makes Up My Credit Score?

FICO® credit scores are the most widely used by lenders. Scores range from 300 to 850.

Atlanta Journal-Constitution, July 6, 2008

Related

5 Comments

Comments are closed.

This is great information!!!!!! But would someone need to stay in debt to have a good score? If that is the case, I don’t care about my score if I have piles of cash. I would rather pay a little bit more for things, instead of being in debt and have to pay 18% interest!!!!!

[…] Link: Why Your Credit Score Matters […]

I couldn’t agree more with John. But creating cash accounts, takes time, for most. I have never carried any revolving debt, and have a great credit score. For most people, paying cash for their first car and home is not realistic. It certainly was not for me. Working a plan to get in position to pay cash for cars and homes, while paying cash for other life’s needs, and using credit wisely in the meantime, will help, in most cases, to facilitate the ability to then pay cash for cars, and then…cash for homes!

Wow Randy! I love your web sight, this is amazing. Well put together i must say. I think I will make one of these too. Thanks 🙂

Your credit score is equivalent to “Your Good Name”.