Charting a New Course

Isabelle Gagnon & Maxime Côté

Laval, QC

Former Occupation: World Travelers

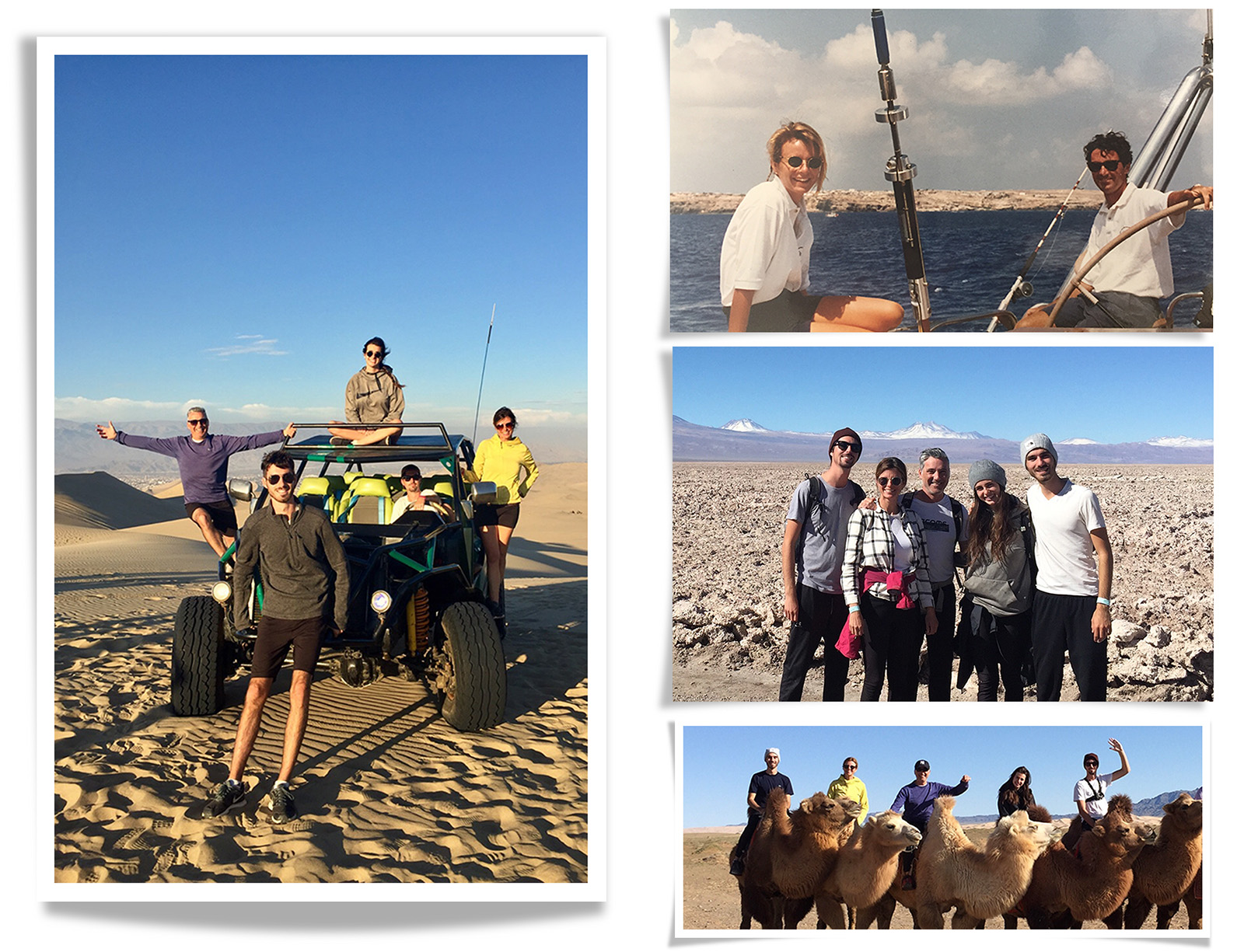

Isabelle Gagnon & Maxime Côté, of Laval, QC, have always dreamed big. The globetrotting couple met one another while backpacking across Europe in their early 20s and spent several years traveling the world together by boat before Max’s brothers introduced them to Primerica.1 They were business partners from the very beginning – looking for an opportunity to keep the feeling of freedom experienced in those years alive.2

For Isabelle and Maxime, the potential offered through Primerica meant a chance to keep their passports in their back pockets while still building a successful career at home. Having relatives who were already established with the Company didn’t hurt, and Max quickly earned his life license and took to building his career full-time once he and Isabelle settled down in Montreal to start a family. 3, 4

“As full-time dreamers, we knew we also needed to be full-time doers,” recounts Max, who instantly became passionate about Primerica’s crusade to correct injustice when he realized his own parents would have been better off had they worked with a Primerica agent before retirement. 5

Isabelle found out she was pregnant with their first child in 1996, and as their family grew, she became licensed and started helping clients as well. Armed with the freedom to build their own business at their own pace and without any limits, Isabelle and Maxime worked tirelessly to do what needed to be done to ensure the financial security of their family.6, 7

“We always put our family first,” says Isabelle. “We made sacrifices as a family, but we didn’t have to sacrifice our family.”

Helping other families become financially independent and accomplish their goals became a major motivator for the couple, and so has recognizing the major impact a few simple financial concepts can have on the lives of an ordinary North American family. The couple is proud to work with a company that changes lives.

“The pandemic has changed the world,” says Isabelle, adding that while families experienced the financial burdens of a higher cost of living and lost wages due to lack of childcare, the business opportunity aspect really showed its strength in the beginning of the new millennium.

Isabelle and Max believe a new way of doing business has only worked to reinforce Primerica’s core values of standing up for Main Street families. They affectionately call this new generation of leaders “Baby Zoomers” – teammates who embraced a new way to conduct business and an onset of new tech tools and resources to maximize their growth and collapse timeframes.

“We strongly believe the power of a hybrid business will allow us to have more time to meet with teammates in person in order to build stronger relationships, while servicing existing clients,” says Isabelle. “When we look at where we are now it makes us so proud. Working whenever you want is a reality now, not just a dream. What a time to build a business!”

Today, Isabelle and Max say they feel the sky truly is the limit. Their Primerica business has afforded them the opportunity to live out their dreams with their three children– by taking a year off to backpack across five continents.

“We are full of gratitude,” exclaims Isabelle. “Primerica has been the vehicle for us to build our perfect life around our family and accomplish our dreams.”

- Primerica offers a business opportunity that involves the sale of term life insurance and various other financial service products. Primerica representatives are independent contractors, not employees. Their earnings are based on the sale of products offered by Primerica and also qualifying product referrals. Importantly, Primerica representatives must be appropriately licensed for each product line before they are qualified to make a sale.

- The Partnership Empowerment Program (PEP) is a recognition program for supportive partnering among Primerica representatives. It does not signify a business or legal partnership. PEP cannot affect, combine or alter contractual compensation, hierarchical agreements or ownership issues.

- Primerica representatives market term life insurance underwritten by National Benefit Life Insurance Company, Home Office: Long Island City, NY in New York State; Primerica Life Insurance Company, Executive Offices: Duluth, GA in all other U.S. jurisdictions; and Primerica Life Insurance Company of Canada, Home Office: Mississauga, Ontario in Canada.

- In Canada, the part-time opportunity may be subject to certain restrictions, depending on your occupation.

- In the U.S., securities and advisory services are offered by PFS Investments Inc., 1 Primerica Parkway, Duluth, Georgia 30099-0001, member FINRA [www.finra.org]. Primerica and PFS Investments Inc. are affiliated companies. PFS Investments Inc. conducts its advisory business under the name Primerica Advisors. In Canada, mutual funds are offered by PFSL Investments Canada Ltd., mutual fund dealer. Head Office: Mississauga, Ontario.

- Ownership refers to the conditional right of an eligible Regional Vice President RVP to transfer his or her business to another eligible RVP, subject to the consent of Primerica and subject to terms, conditions and regulatory requirements. The Ownership Program Document and policies located on Primerica Online (POL) control in all respects.

- From January 1 through December 31, 2021, Primerica paid cash flow to its North American sales force at an average of $8,410, which includes commissions paid on all lines of business to life licensed representatives. Figures include U.S. and Canadian dollars remaining in the local currency earned by the representative, not adjusted for exchange rates.

Summary

For Isabelle and Maxime Gagnon, of Laval, QC, the potential offered through Primerica meant a chance to keep their passports in their back pockets while still building a successful career at home.