The end of the year is approaching fast. Do you need a financial tune-up? Here are a few areas to consider as you reflect and review:

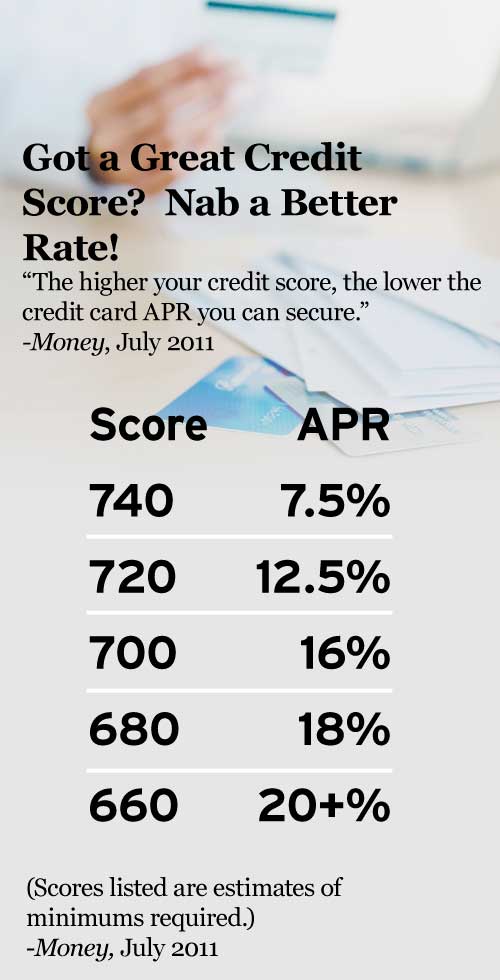

Review your credit cards. Do you have a stellar credit score? With industry competition fierce for your business, you may be able to ask for – and receive – a lower Annual Percentage Rate (APR). While the average variable APR for credit cards is 14.46%, those with super-high credit scores can actually cut that in half (see chart below). If you’re among that elite crowd – and aren’t happy with your current rate or terms – try contacting customer service. You could negotiate your way to a better rate, or persuade them to waive the annual charge.

What’s your get-out-of-debt plan? Are you worried about your debt? If you’ve ever thought about making a dent in your debt (or changing your credit habits), now’s the time! Approximately 63% of Americans who are in debt say they worry about money one to three hours a day, and 22% worry four-plus hours a day. If you’re among them, ask your Primerica Representative how Primerica Debtwatchers™ can show you how to create a plan to gain control of your credit for good.

Check your emergency savings. Do you have three to six months’ salary stashed? If not, you’re not alone – a majority of Americans say they don’t have enough cash on hand to cover a $1,000 emergency expense.[1] To find extra cash for your emergency fund, get creative: take on extra work (ask your Primerica Representative how you can earn extra money part-time by helping families with their finances) or trim some of the “extras” from your monthly bills (think entertainment costs like dining out and cable/satellite service).

Review your life insurance coverage. If you have had a change in your life – such as the birth of a baby – this is crucial. Financial experts generally recommend about six to 10 times your annual salary. Nearly a third of all U.S. households have no life insurance, the highest percentage in more than four decades.[2] Among households with children younger than 18, 40% said they would immediately have trouble keeping up with living expenses if a wage earner passed away.[3] Don’t let a troubled economy put your family’s financial future at risk: Talk to your Primerica representative to make sure you’re (still) properly protected.

Re-shop your auto insurance. If you haven’t comparison-shopped your rates lately, give it a try! For an identical six-month policy, costs can vary as much as $500 across carriers – yet only 20% of consumers actually take the time to shop around![4] Too busy to shop? Ask your Primerica representative about Primerica Secure®, a referral program that shops multiple carriers for you!

Do you have a will? Two-thirds of Americans do not, according to a 2010 survey.[5] You can pay a lawyer anywhere from $100 to $1,000 to crate a will,[6] or ask your Primerica representative about the Primerica Legal Protection Program (PLPP), which includes free will preparation among its many benefits.

- Money, July 2011

- USA Today, January 7-9, 2011

- Primerica, representatives of Primerica, Equifax and Primerica DebtWatchers™ will not act as an intermediary between Primerica DebtWatchers customers and their creditors and do not imply, promise or guarantee that credit files or credit scores will or may be improved, repaired, boosted, enhanced, corrected or increased by use of the Primerica DebtWatchers product. Primerica DebtWatchers™ is a trademark of Primerica, Inc. Primerica DebtWatchers is not available for purchase.

- CNNMoney.com, August 10, 2011

- Wall Street Journal, August 29, 2010

- Ibid